Oil Prices: Explained

Yesterday, we read the news headlines that the oil prices plunged to negative. What does that mean? Will you get paid for filling gas in your car? The answer is obviously NO. These values are based on the price of oil futures and expiring contracts.

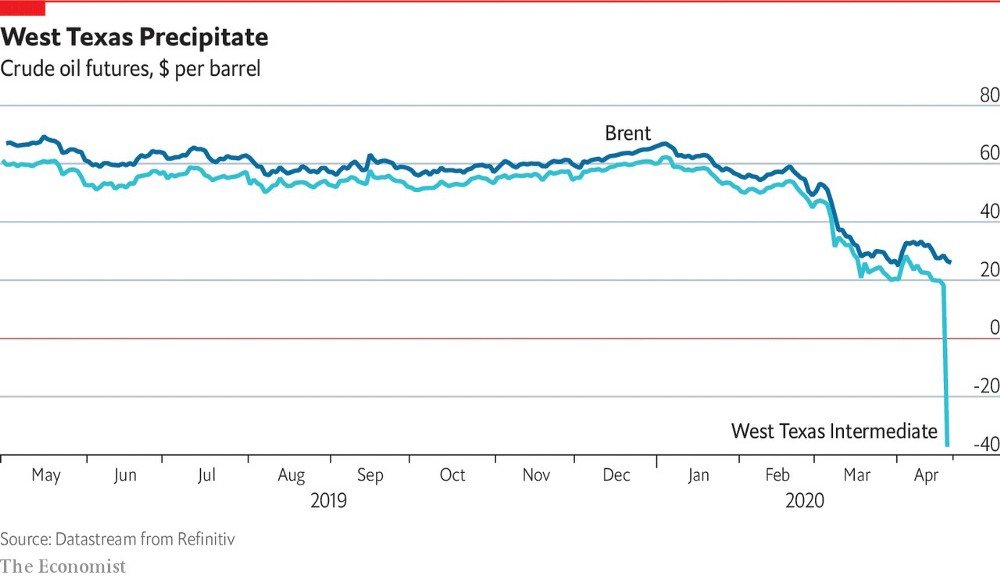

It was the price of WTI crude that would be delivered in May, which fell as low as -$40 a barrel yesterday. It was the first time that the price on a futures contract for oil has gone negative. Apart from sending shockwaves throughout the industry, this scenario has wrecked models that financial institutions rely on to estimate risk.

Below is a chart of West Texas Intermediate, where you can see the futures oil prices have gone below zero to a negative value per barrel.

Why has this happened?

Storage: The United States is running out of room for oil, and people expect that there is no more storage capacity in the very short term, which is making the prices go negative. The price for oil that is set to be delivered in June is still positive, around $20 a barrel at the time of writing this.

Due to the Coronavirus pandemic, there was an unprecedented drop in the demand for oil. The production of oil also did not go down as fast enough. Because of the time to process oil and how it is bought and sold, it makes sense that supply lags the demand.

The Saudi — Russia price war also added fuel to the fire.

What does it mean for the economy?

The energy companies in the S&P 500 stock index are down roughly 60 percent this year

Many oil companies have taken on too much debt when times are good, and many of them won’t be able to survive this downturn. US oil companies are racing to restructure this debt. Below is a graph from CNN Business, showing the predicted number of bankruptcies based on oil prices at different levels.

This is also a huge red flag for speculators in the futures market. This scenario has shown that physical constraints like storage and logistical bottlenecks can drive prices negative.

Bonus: What does it mean when you hear oil markets are in “super contango”?

Contango and backwardation are terms used to describe the shape of the futures curve.

When a market is in contango, it means the futures price is higher than the spot price. The higher future price for a particular expiration date is typically associated with the cost of carry and storage.

When a market is in backwardation, it means the forward price of the futures contract is lower than the spot price. The futures forward curve may become backwardated in physically-delivered contracts because there may be a benefit to owning the physical material, such as keeping a production process running. Oil, for instance, is considered as a market with finite supply but with high demand. People are willing to pay more for delivery today than receive later.

In this scenario, oil markets have moved from normal backwardation to contango as supply has grown, and the convenience yield has fallen.